Property Tax New Year Prep – Residential Property Owners

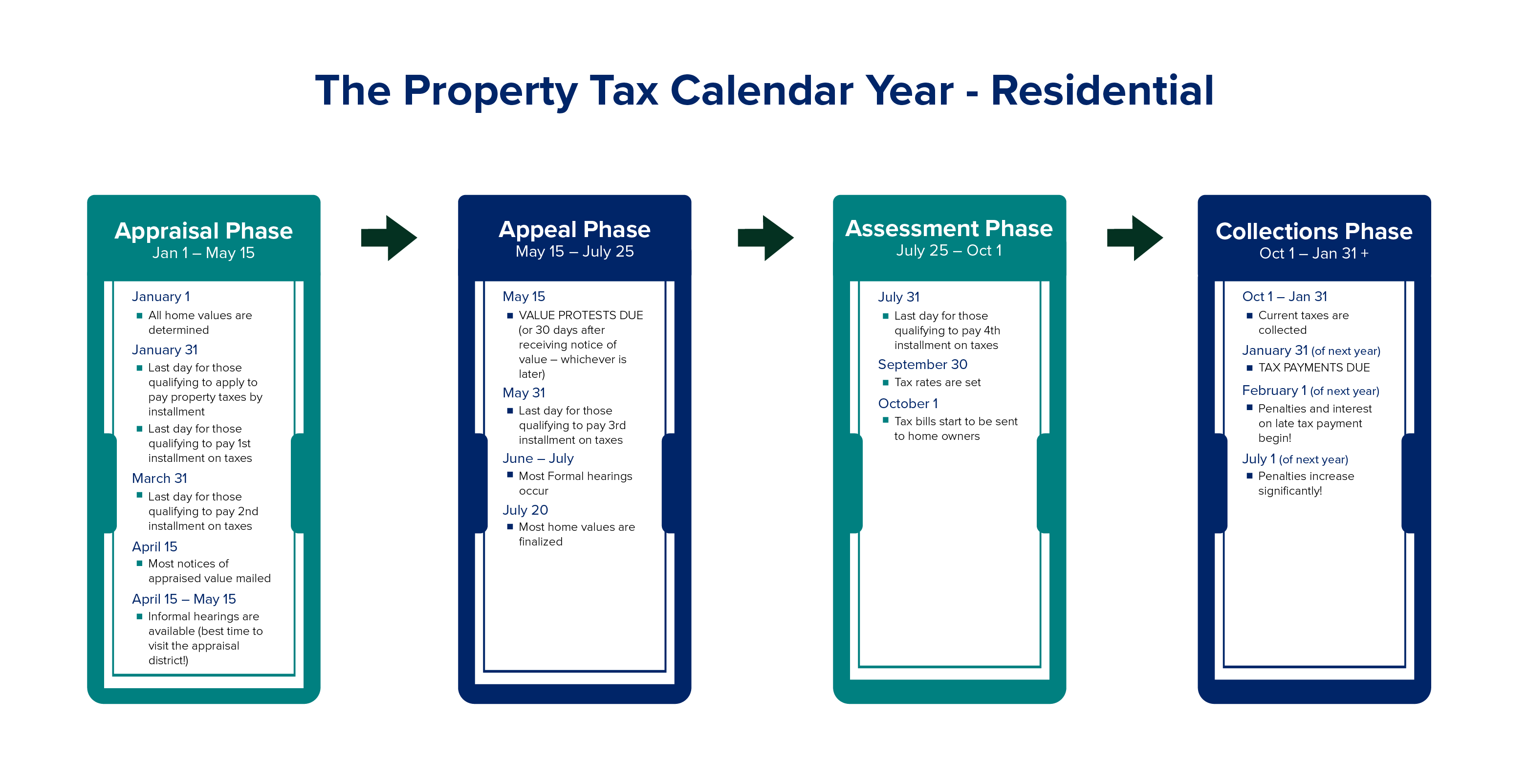

It’s property tax appeal time again!

As an authorized agent of your residential property, we will file your protest timely unless you instruct us otherwise. Whether your valuation changed or remained the same, your real valuation may be lower. Our objective is to minimize your property tax obligations to “BIG TEX”.

To begin the process for residential properties, your property tax agent will need the following:

- Closing statements on any new purchases beginning January 1, 2019.

- For existing properties, please include details of any added improvements and other changes in condition. This includes photos of damage, foundation issues, and anything else that might show disrepair. Areas of the house that take priority are kitchens, bathrooms, and main living areas.

- Building a new house or an addition? Send over construction documents.

In addition to providing a fuller report of the true value of your home, we will compare your property to other similar properties in the area. The Property Tax Code provides that your property should be valued no higher than the adjusted median value of similar properties. Over the years, we have been extremely successful using the Equal and Uniform approach. We expect to be successful this year as well.

The appraisal districts will be very tough in supporting their valuations. As always, we look forward to being extra tough in obtaining your reductions.

Your business is greatly appreciated. Our purpose is to continue to make your properties worthless at the appraisal districts.

No Comments